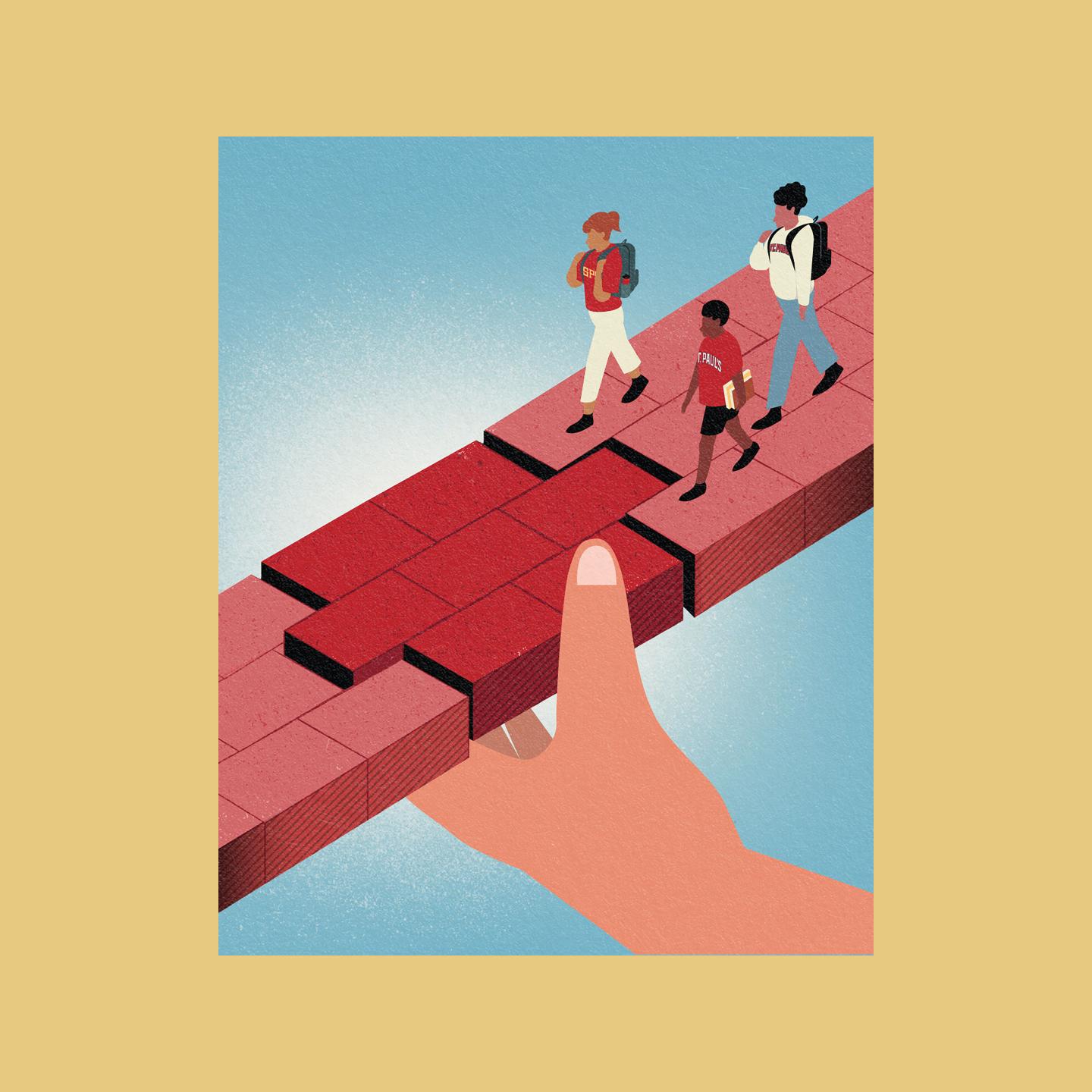

A history of generous philanthropy has provided the foundation on which St. Paul’s School has built excellence for generations of students. Go inside the endowment and learn how it is managed, what it funds (and what it doesn’t), and why gifts from both the past and present are essential investments in the School’s future.

In 1859, three years after St. Paul’s School opened, founder George C. Shattuck made a gift of $10,000 to the School, calling it the “Founder’s Scholarship.” On the deed of gift, he stipulated two restrictions: one on the principal, which “shall be always kept invested in some proper manner… ,” and the second on the fund’s income, directing it “to be expended for at least two scholarships… .”

That endowed fund, the first monetary gift recorded by the School and since renamed the “Founder’s Financial Aid Funds,” has a fair market value today of more than $1 million, and its revenue continues to be distributed as directed by Dr. Shattuck. It is one of nearly 800 funds that comprise the School’s endowment, valued at $747 million as of April 30, 2024.

This tradition of reinvesting in our students was further consolidated on June 26, 1906, when the Alumni Association “voted to raise an Endowment Fund to commemorate the Fiftieth Anniversary of the School; such Fund to be a permanent one for the general endowment of the School.” Third Rector Henry Ferguson recorded this vote in his Report of the Endowment Committee, indicating that the formal work to fund School operations and assure the long-term health of the institution through an investment strategy had begun. Since then, the endowment has grown substantially, thanks to over a century of generous, intergenerational investment in the School’s excellence by hundreds of alumni and families. Of the hundreds of funds that comprise the endowment, only five have principal values (the original amount of the donation) of $5 million or greater, demonstrating the collective power of many smaller gifts accumulating value over time.

The Endowment Today

Today, earnings from the “general endowment” provide the largest source of revenue for St. Paul’s School (54%). Other revenue sources include tuition (34%) and annual gifts to the SPS Fund (10%). Invested as a single pool of assets, the general endowment serves the School well in the short and long term by providing consistent annual financial support while ensuring long-term stability and growth from which to draw on in future years. To serve these dual purposes requires careful management, and the School’s assets have been the purview of its Board of Trustees since the governing body first convened in 1855 in the front parlor of Dr. Shattuck’s house.

SPS Board members are the legal fiduciaries of the general endowment, along with members of the School’s Investment Committee — a group of current and former trustees, alumni and SPS administrators who oversee the School’s investment strategy with the goal of long-term growth of the assets. The Board defines the School’s endowment spending policy, determining what portion of the endowment is paid out as an annual distribution to support the School’s budget every year. Importantly, what is paid out is not the principal of the endowment but rather a small portion of its appreciated fair market value — ranging from 4% and 5%, though the exact number each year is determined based on a three-year rolling average of the general endowment’s fiscal year value. (In fiscal year 2022-23, the endowment payout rate was 4.85%.) Equally important, even in years of particularly robust market performance, the School never spends all of the endowment’s investment earnings; instead, any amount earned above the 4% to 5% annual “draw” remains invested in the endowment for its continued growth. In determining the annual distribution, the Board balances the spending needs of today against the goal of maintaining the endowment’s purchasing power over time to ensure it will provide a financial foundation to the School for generations to come.

The Investment Committee targets a return that exceeds inflation plus annual spending each year. To achieve this result, the School’s investment strategy balances growth- oriented investing with portfolio diversification across a wide variety of industries, geographies and asset classes to mitigate risk and enhance returns; active management to create incremental value; and the liquidity necessary to ensure downside protection in times of market and economic stress. The underlying principle is that growth investments offer superior revenue and earnings potential that will drive a larger increase over time. To ensure active management, in April 2022, St. Paul’s School engaged Partners Capital to provide the School and the Board of Trustees with full-time oversight of the endowment portfolio allocations, investment opportunities and liquidity needs all within the strategic investment objectives of the School. “Outsourcing the function of a chief investment officer is an excellent alternative for schools not seeking to build their own internal investment office,” Chief Financial and Administrative Officer Brooks Seay says. “With over $50 billion in assets under management, Partners Capital is known for its ability to successfully manage sophisticated pools of assets, recognizing the importance of preservation of capital, purchasing power parity and meeting liquidity needs while generating a sufficient return on investment.”

Designated Spending

“Here on the grounds, we experience every single gift as an investment or reinvestment in the excellence of the experience of our students,” Rector Kathy Giles says. “Every gift matters. Many people marvel at the size of our endowment, and yes, mission-directed giving over the last century-plus has created incredible resources for our School. An endowment, however, is not a bank account, and ours is highly restricted — with gifts aligning with donors’ interests and wishes so that the gifts support specific programs rather than immediate needs.”

When Edward S. Harkness, Form of 1893, drew up his estate plans prior to his death in 1940, he included a gift to the School in the amount of $1.1 million, about 90% of which was designated to be used for the School’s “general purpose.” A smaller restricted fund also was established, with about $100,000 going to a maintenance fund for the New Study Building, now known as Schoolhouse — home to the Languages and Humanities Departments. Today, the combined market value of Harkness’ gift is $25.6 million (as of Dec. 23, 2023), a sizable contribution to the student experience and an incredible testament to the equation of generosity plus time equaling an enduring legacy that changes lives in service to the greater good.

The Edward S. Harkness Fund is one of 15 planned gifts with principal values of $1 million or greater that represent 28% of the endowment, or approximately $200 million of its market value. These gifts span nearly a century of philanthropy — the first gift recorded in 1925 and the most recent in 2020 — and are cornerstones to the School community’s ability to thrive and excel in the 21st century.

Approximately 77% of the endowment is made up of restricted funds — the designations of which cannot, without the approval of the donor or their representative, be allocated for other School priorities or areas of emerging need. The remainder of the endowed funds (23%) are Board-directed — gifts designed to provide School leadership and the Board of Trustees with the flexibility to choose where to invest the funds’ annual payouts — such as operational priorities, financial aid and capital investments.

Examples of what individual endowed fund payouts support each year are numerous — including several represented in the pages of this Horae. Retired Navy Admiral John Richardson, the country’s 31st Chief of Naval Operations, spent two days on grounds as the year’s Conroy Distinguished Visitor, thanks to the endowed speakership for which the program is named. The hit production of “The Addams Family” spring musical, which debuted in May, drew support from funds like the Greve Fund for the Performing Arts and the deWilde Family Theatre Fund. Dedicated teachers (and puzzle masters) like Science and Math Teacher Chris Morse are supported by Board-directed funds as well as restricted funds for faculty and academic support, like the John S. Schweppe Fund for Support of Excellence in the Sciences and the The Ernest duPont, Jr. Fund in Support of the Sciences. And student-athletes like the 39 college recruits from the Form of 2024 benefit from funds like the Baker Fund for Physical Education.

“Gifts made to support financial aid, compensation and benefits, arts, athletics, and everything funded through our operating budget are reinvestments in the excellence of the student experience for which we stand,” Giles says. “Very few young people live and learn and grow together with the kinds of opportunities with which our students engage, and principal among them is the invitation to integrate their intellectual, physical, emotional and spiritual growth as they come of age in a complex and challenging world. There is nothing more important than investing in the education of children, the next generation of citizens and leaders, and nothing more generous than investing in those children even when you know you will never meet them, and they will never know who you are.”

As Board President David Scully ’79, P’21 states in the accompanying piece, “the endowment is doing all that it can” to provide the kind of SPS experience for students today that generations of alumni have enjoyed, and that future students also will experience thanks to the community’s rich history of philanthropy and the careful stewardship of those investments. The question becomes how to augment the endowment draw to advance the School’s position of strength as a fully residential school committed to the pursuit of excellence in character and scholarship, in service to the greater good.